Probability & Partners: Wtp requires better model risk management

This column was originally written in Dutch. This is an English translation.

By Erik Kooistra, FRM Service Line Lead Model Validation at Probability & Partners

In the pension sector, the dependence on models is considerable. Models help, among other things, in making important strategic decisions, calculating actuarial pension liabilities and conducting ALM analyzes and risk assessment analyses.

With the introduction of the Future Pensions Act (Wtp), this dependence on models will increase even further, which increases the need for thorough model risk management. This is the process by which pension funds manage risks associated with the use of models. Model risk is the risk that a model does not deliver the correct results due to incorrect assumptions, inadequate data, incorrect implementation or incorrect use of the model. For pension funds, this means that strategic decisions may be based on incorrect or distorted information, with potentially far-reaching financial consequences.

The current model risk management framework of the Pension Federation, which was drawn up in 2015 and revised in 2021, provides pension funds with a basis. My question is whether this framework is still sufficient in the new situation, in which the Wtp leads to more complexity of schemes that pension funds have to offer to participants. This changes the objective, size and scope of current models. The vulnerability lies mainly in the new application of existing and new models during the transition.

The service document of the Pension Federation

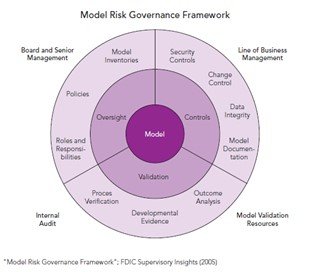

The model risk management framework that is often used by pension funds originates from the service document of the Pension Federation. This document provides guidance on establishing a model governance structure, integrating model risk into strategic decision-making, and establishing standards for the use of models. The model risk governance framework, as depicted in Figure 1, offers pension funds a first step to clearly define responsibilities and identify model risks.

Yet the complexity that the Wtp entails raises new questions. Are these standards still sufficient for the models required for the transition to the new pension system? Models that previously functioned well now need to be reevaluated and adapted to the new circumstances. This change creates additional risk, especially for pension funds that do not manage their models themselves, but depend on external service providers. This involves a major model risk: the models used by different parties are often based on different assumptions and design choices, so that the same input can lead to different outcomes and decisions.

Figure 1: Model risk governance framework from the Pension Federation service document

Relevant models in the Wtp transition

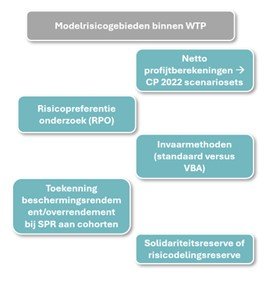

Within the Wtp transition, some models will be particularly relevant in the area of model risk (see Figure 2), for example the net benefit calculations, which determine how existing rights are converted to the new scheme, based on scenarios from De Nederlandsche Bank (DNB) that were generated with the CP2022 model of the Parameters Committee. The choices made in these models will have a major impact on participants' pensions.

Risk preference surveys (RPO) also play an important role. These studies, conducted by external agencies, determine the risk attitude of participants based on model-based assumptions. Errors or different assumptions in these models can lead to different model outcomes, which in turn can lead to risky strategic choices.

Figure 2: Relevant models within Wtp in terms of model risk

The models behind the solidarity and flexible premium schemes are also crucial. In the solidarity premium scheme, funds must make choices about allocation rules for returns and deal with the consequences of micro and macro risks such as longevity risks. The methods used, such as the Ortec method in the payment phase, must be accurately substantiated to ensure that the results are balanced and robust. In the flexible premium scheme, the connections between asset management and pension administration play an important role. Because participants in this case have individually traceable participations, implementation and data registration must be error-free.

These decisions and model choices have far-reaching consequences for participants' pensions. To manage these risks, pension funds must ensure that the models they use are accurate and reliable. An essential part of this is the use of plausibility checks, as recommended by DNB. These checks help pension funds to verify that the models deliver the correct results, which is especially important in the context of the Wtp transition.

The model risk vulnerabilities mainly lie in the new application of existing and new models due to the transition. This becomes extra difficult to control if a pension fund does not have the models itself. An additional problem is that funds often rely on ISAE statements from their service providers, which only assess whether processes are being followed correctly. However, this does not guarantee that the models used themselves are accurate and complete.

The risk mainly arises because different service providers make their own design choices for their models, which can lead to different results and decisions. The use of sensitivity analyses, which map the outcome distributions of different models, is a crucial tool for managing these risks.

Indispensable model governance elements

Pension funds are in a transition phase that entails new and complex model risks. It is vital that funds keep their model risk management up to date and ensure robust validation and monitoring of the models they use. For example, specific model governance elements from other sectors can be indispensable for monitoring models. This includes elements such as model inventory, model ownership, model approval policy, model documentation and validation reports. For this I would like to refer to our paper, which discusses this in more detail. Above all, more attention and capacity is needed for model validation to meet the needs of the models through the transition.

Conclusion

The decisions and model choices made by pension funds have far-reaching consequences for the pensions of participants. In my opinion, the current model risk management framework of the Pension Federation is no longer sufficient due to new and complex model risks arising from the Wtp. Therefore, a revision is needed to ensure that this framework meets the requirements of the new pension system. The use of independent model validation, sensitivity analyzes and continuous monitoring is crucial to guarantee the financial security of pension funds and their participants.