Harry Geels: The West is not so different from China anymore

Harry Geels: The West is not so different from China anymore

This column was originally written in Dutch. This is an English translation.

By Harry Geels

The oligarchic form of capitalism that characterises the US and the corporate welfare capitalism (perhaps better known as socialism for the rich) of Europe are not so different from the state capitalism of China. There are few arguments left for excluding China but including the US as an investment theme.

Last Saturday, the FD newspaper published an essay entitled ‘Time to say goodbye to the free market and its imperfections’. These kinds of articles full of free-market bashing and pleas for government intervention and planning are a regular occurrence. There are three objections to these kinds of appeals. Firstly, the terms ‘free market’ or ‘capitalism’ are rarely defined. Secondly, the amount of violence that has already been inflicted on the free market is underestimated. Thirdly, no evidence is ever provided to suggest that government planning would work better.

1) No clear framework

There are many definitions of what capitalism – the system that most clearly promotes free markets – actually is. Most definitions emphasise four aspects: limited government intervention (basically only to regulate matters that the market does not address, such as the police, army and judiciary), competition (which promotes efficiency), private property (which guarantees the entrepreneur that he will receive his earnings) and freedom of investment and consumption.

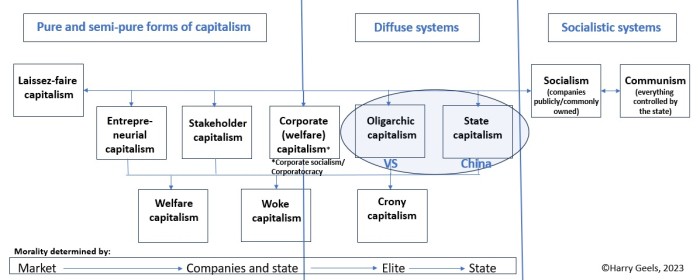

Each of these four factors can have a range of grey areas. This has led to the emergence of different variants of capitalism, as shown in Figure 1. The purest form is laissez-faire capitalism, with the least possible state interference. Morality is also determined by the market here. In recent decades, capitalism has taken on different guises. The US has many characteristics of an oligarchic form of capitalism, China of state capitalism and Russia of crony capitalism.

Figure 1: Different forms of capitalism

The oligarchic form involves an interplay between large companies and the government. Nobel Prize winner Milton Friedman always made a clear distinction between ‘Free Enterprise’ and ‘Big Business’. He warned against Big Business and Big Government due to the danger of concentrations of power. Figure 1 clearly shows how American capitalism is edging closer to that of China. The only difference is that in China the state determines morality, while in the West it is determined by a vague mixture of Big Business and government.

2) Free markets are a thing of the past

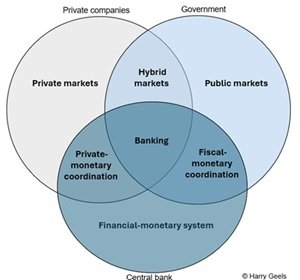

The second problem with the kind of appeals we read in the FD is that the free markets barely exist. While point 1 still dealt with the question of definition, current practice also shows heavy interference from the authorities and the remnants of the private markets. In most Western countries, the government already accounts for more than 40% of the GDP. There are many hybrid companies (with the government as a shareholder), central banks steer monetary policy, and what is left of private markets is highly regulated.

Figure 2: Relationship between government, central banks and private markets

3) Better for whom?

Thirdly, a plea for more government intervention implies that central policy would work better. But let's make a list of failed government policies. Moreover, as soon as the government intervenes, winners and losers are created. For example, rescuing large companies leads to a wealth transfer from taxpayers to the stakeholders of the companies in question. Import tariffs – the EU is also no stranger to these, certainly when it comes to the import of agricultural products – are (temporarily) good for producers, but bad for consumers. So who does this benefit?

Government plans

A major difference between Chinese state capitalism and the Western mix of Big Business and Big Government is sometimes stated to be that the Chinese 5-year plans are purely government-driven. But the West also makes many multi-year plans. Think of the Green Deal, War Bonds, the SDG agendas and climate objectives. Moreover, the Chinese government's latest plans promote the free market and private initiatives more than ever, while the West is increasingly leaning on centralised industrial policy.

China as an investment theme

It is difficult to find a good justification for excluding China as an investment theme. In fact, many investors are once again looking at China, (unconsciously) realising that Western capitalism differs little from that of China and Chinese shares are cheaper.

One difference does stand out. Chinese companies and consumers have to toe the government line more than those in the West. In China, dissidents disappear from the scene, in the West they are mainly cancelled.

This article contains the personal opinion of Harry Geels