J.P. Morgan AM: Cooling data shouldn’t yet change the course for the BoE

J.P. Morgan AM: Cooling data shouldn’t yet change the course for the BoE

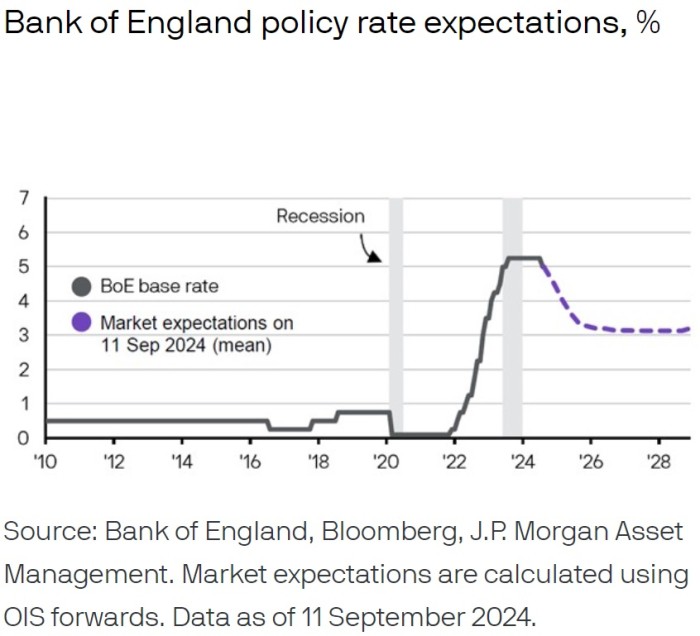

Despite a series of cooler economic data prints in the UK last week, the Bank of England (BoE) still looks unlikely to deliver another rate cut at Thursday’s meeting.

While the recent moderation in wage growth adds credence to the BoE’s assessment that the wage-price cycle is unwinding, overall the labour market remains tight. Last week’s July GDP print was also softer than expected, yet we do not believe this is indicative of a new trend.

Other measures of economic activity, such as the Purchasing Managers’ Indices, point to an economy that is still firmly in expansionary territory. The BoE may therefore prefer to wait until its November meeting to assess whether further easing is warranted. In doing so, it could also incorporate any potential impact on the macro outlook from the upcoming UK budget and the US election result.