Columbia Threadneedle: Dollar strengthens amid anticipated market volatility

Columbia Threadneedle: Dollar strengthens amid anticipated market volatility

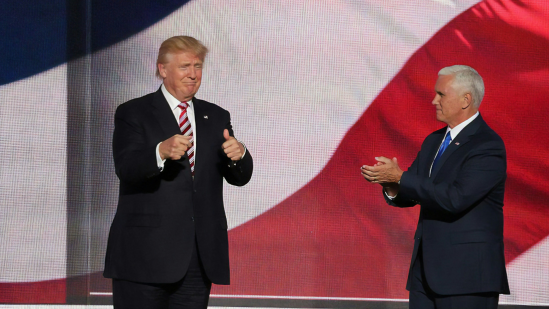

Several investment specialists from Columbia Threadneedle Investments commented on the US Presidential Election result today.

MACRO

William Davies, Chief Investment Officer at Columbia Threadneedle, noted: “President Trump’s victory has surprised some, but markets had priced in risk ahead of the US Presidential Election. The dollar has strengthened against other currencies, as would have been expected, and we anticipate that the S&P will benefit from this outcome.” He added that while other markets may experience volatility in the coming weeks, the effects of policies like trade tariffs are likely to be more gradual, unfolding through 2025 and beyond.

US EQUITIES

Andrew Smith, Client Portfolio Manager, Columbia Threadneedle, commented: “For once, the polls were right! Well, nearly.” Although some pollsters had Vice President Kamala Harris slightly ahead in the popular vote, Trump’s narrow lead across swing states—especially Pennsylvania—ultimately secured his victory. Smith highlights that “President Trump is the first president in over a century to reclaim the White House after losing it.”

Smith notes that the election outcome could bring both volatility and opportunity to the markets. “The Republican party’s likely control of the Presidency, Senate, and House of Representatives could lead to sweeping legislative changes,” he explains, adding that financials and extractive industries, such as oil and gas, may benefit in the short term from the administration’s pro-deregulation stance. However, Smith does not foresee major reversals in key initiatives like the Inflation Reduction Act (IRA), given its impact on job growth and investment in key Republican states.

Small-cap stocks may also see a boost. Smith points to the outperformance of small caps following Trump’s 2016 win, where the Russell 2000 surpassed the S&P 500 by nearly 11% within a month. While this effect may be more tempered this time around, Smith suggests that “the decisive Republican victory creates a more constructive outlook for small caps.”

Despite the immediate market reactions, Smith reminds investors to focus on the long term. “It’s worth noting that the party in power has actually had very little bearing on long-term stock market returns. As the old adage goes, it’s the time spent invested in the market that really matters. Presidents come and go, but the stock market remains.”

EUROPEAN EQUITIES

Francis Ellison, Client Portfolio Manager for European Equities, Columbia Threadneedle, emphasizes the need to assess the implications of President Trump’s victory for European companies and markets. He reflects on the outcome of the 2016 election, noting: “When President Trump was elected in 2016, there was an immediate assumption that his policies would be reflationary, but this was not entirely borne out by subsequent developments. The reality was more nuanced, and to some extent more confused.”

Ellison suggests that one potential change in foreign policy could involve a more forceful attempt to resolve the Ukraine conflict and increase cooperation with Russia, which would benefit Europe by reducing oil prices, where the continent is a major importer. “So we would expect European growth to rise and European inflation to fall,” he adds.

However, Ellison also points to the possibility of escalating tensions with China, continuing the theme from President Trump’s 2016 policies. “This is likely to put pressure on any Europeans who trade there; European companies may also face rising tariff threats from the U.S.,” he says. Industries like autos, where Columbia Threadneedle has limited exposure, may be affected, although much of this is already reflected in current prices. He also notes that luxury goods could be penalized, with a potential trade battle with China worsening the situation for this key European sector. “Our exposure here has also reduced, and is much more selective stock by stock, as impacts will vary.”

Ellison concludes with an important note on the political landscape: “Probably the most important theme is how effective the U.S. government can be with the Republicans winning control of the Senate and, at the time of writing, making gains in the House. This makes it more likely that they can push through legislation where previous Presidents could not. Foreign policy will be important as President Trump looks to negotiate pacts to extend and improve U.S. influence.”

EMERGING MARKET EQUITIES

Krishan Selva, Client Portfolio Manager for Emerging Market Equities, Columbia Threadneedle, commented on the potential impact of a second Donald Trump presidency on emerging market (EM) equities, stating: “The impact of a second Donald Trump presidency on emerging market equities will likely hinge on trade policies, US dollar strength, and geopolitical stability. This will create both risks and opportunities for us to navigate.”

Trade Policies:

“President Trump’s prior administration was known for its aggressive stance on tariffs, especially towards China, and during the current election campaign he continued this rhetoric. Could the threat of tariffs be used to make a deal? After all, President Trump stated he has no issue with Chinese automotive firm, BYD, opening a factory in Michigan given his desire to reindustrialise the US and create blue-collar jobs. President Trump also stated his intention to impose additional tariffs on China if China were to ‘go into Taiwan’. What we can conclude is that tariffs will lead to increased costs for emerging market exporters dependent on US demand. On the flip side, other emerging market exporters could benefit from companies relocating supply chains, to areas such as Southeast Asia and Latin America.”

US Dollar Strength:

“Historically, a stronger dollar is a headwind for emerging markets. President Trump’s administration may push for tax cuts and spending, which could boost US economic growth, resulting in higher interest rates, and might lead to a stronger dollar. President Trump has also been an advocate of a weaker dollar for trade purposes, but this did not materialise during his first term as President. Currencies tend to offset the impact of tariffs. As such, the currencies of economies targeted by tariffs should weaken against the US dollar and could present opportunities for emerging market economies to trade in competition with the US.”

Geopolitical Stability:

“President Trump’s first term included tensions with various countries and a cautious approach to multilateral organisations. Renewed tensions could create uncertainty in emerging markets, especially Asia, impacting investor confidence. However, during this campaign President Trump clearly took an anti-war stance.”

“President Trump has also communicated that he is set on ending the Russia-Ukraine conflict, which will likely require China to help with negotiations. As for the Middle East, President Trump is likely to reinforce his support for Israel and push to improve diplomatic relations between Israel and Saudi Arabia, although hurdles need to be overcome.”

“In conclusion, as active long-term investors, we will await specific policy details to understand their impact on trade, US dollar strength, and geopolitical stability.”