Harry Geels: Two comments on relatively high Dutch inflation

Harry Geels: Two comments on relatively high Dutch inflation

This column was originally written in Dutch. This is an English translation.

By Harry Geels

DNB recently charted the relatively (too) high inflation in the Netherlands. For a complete picture, however, two additions are needed, namely with regard to relatively high rising wages in our country and the weak euro.

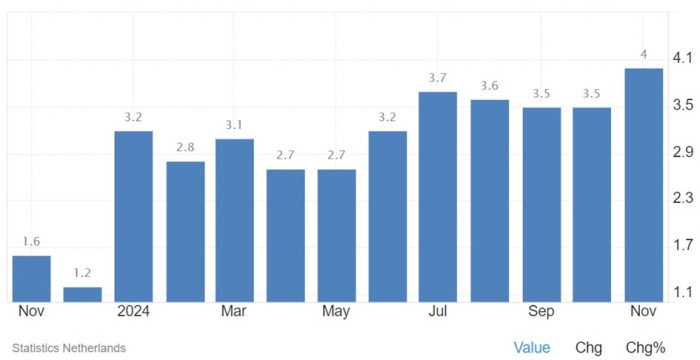

In the Netherlands, inflation for November reached 4%. That is double the ECB's 2% target and also high relative to the rest of the eurozone. Inflation is a serious phenomenon because it indicates underlying imbalances in the economy and a loss of purchasing power for those who find it difficult to compensate for their inflation. It is good that DNB recently listed the causes of high inflation. But there are still a few observations to be made.

Figure 1: 4% inflation for the Netherlands in November 2024

Five causes for inflation

DNB comes up with five causes for high inflation. First, VAT and excise duty increases on soft drinks, tobacco, alcohol and natural gas took place this year. Alcohol and tobacco alone produced 0.6% inflation this year. Second, wages rose relatively hard in the Netherlands, which producers passed on in prices, according to DNB. Due to the tightness in the labour market, workers (finally) have relatively good bargaining positions and these are apparently being played out this year.

Third, companies have also been able to increase profits, especially in markets with insufficient competition. Fourth, rents in the Netherlands are rising in line with inflation measures. The average rent increase this year was a whopping 5.4%. For 2025, rising rents will again contribute to inflation. Finally, the relatively well-functioning Dutch economy also plays a role. DNB: ‘So there is actually too much demand for products, personnel and services.’

First note: the weak euro

DNB makes another justified observation in its analysis, namely that the ECB's policy rate is actually too low for our relatively well-run economy. The ECB should align monetary policy with the eurozone as a whole. However, it is more likely to tailor policy to the weaker eurozone countries, because otherwise, with monetary policy too tight, they will get into further trouble. For the euro, ‘one size does not fit all’ applies. One interest rate policy does not actually work for diverging economies.

Then there is an unmentioned inflation factor, namely the relatively weak euro, which reflects Europe's economic strength (or rather weakness). That weak euro also contributes to inflation via imported products and services from abroad. The Netherlands has always had a strong currency before the introduction of the euro. That arguably led to welfare gains. That policy is no more. Inadvertently, the ECB has been pursuing an increasingly Latin (read looser) monetary policy.

Second observation: the labour market

Of course, DNB and ECB will not be quick to point out the euro's flaws. That is why they point to tackling too rapid wage growth in the Netherlands. DNB director Olaf Sleijpen even warns of a wage-price spiral in the Netherlands, which could make inflation a structural phenomenon, with all its negative consequences. Such a call is extraordinary because this is how DNB wants to intervene in the labour market, which should be determined by supply and demand. Workers actually just want to be compensated (finally).

Moreover, if the Netherlands becomes more expensive (partly due to higher wages), this would slightly worsen its competitive position, which could slightly correct our huge trade surplus. A better solution against relatively high inflation is a government that spends a little less than usual. The best way to counter current inflation is through a decreasing budget deficit. En passant, we will then also not burden the new generations with debts we feel we have to incur now.

This article contains a personal opinion of Harry Geels